Account reconciliation – the process of matching your financial records with external sources like bank statements – can be a time-consuming and error-prone nightmare. But fear not, finance professionals and business owners! Automated account reconciliation is here to revolutionize the way you manage your finances, freeing you to focus on what truly matters.

What is Automated Account Reconciliation?

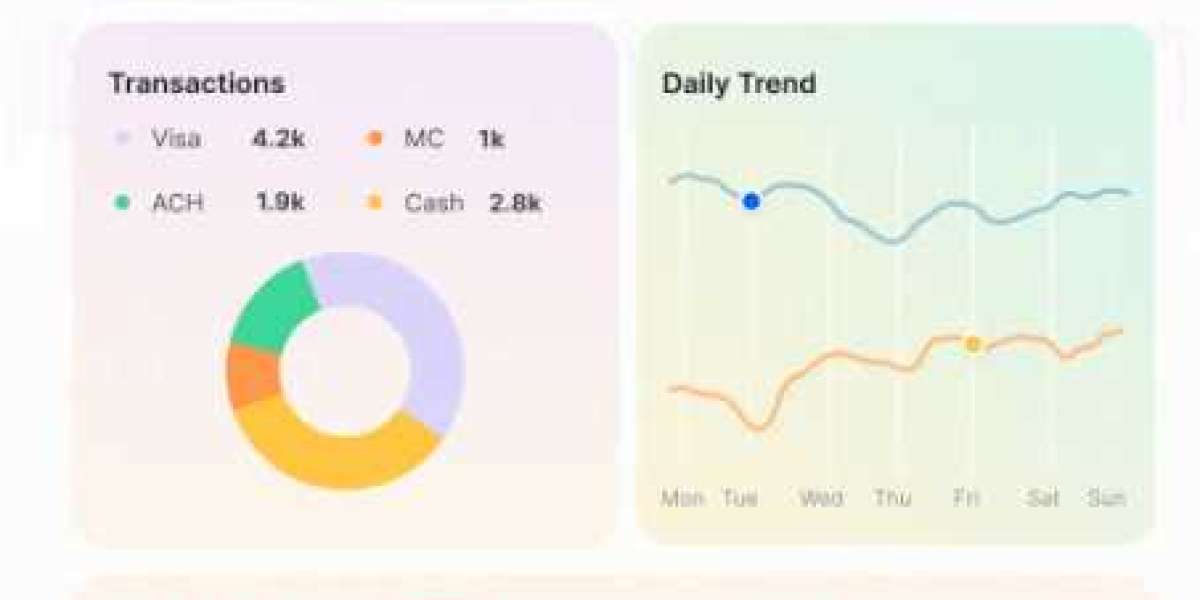

Automated account reconciliation dedicated to streamlining your reconciliation tasks. Automated account reconciliation software acts as that very assistant. It securely connects to various data sources, including bank accounts, credit card statements, and your accounting software. Here's what happens behind the scenes:

Effortless Data Acquisition: Ditch manual data entry! The software securely retrieves transaction data from your chosen sources, eliminating the risk of errors and saving valuable time.

Intelligent Matching Powerhouse: This software utilizes smart algorithms to automatically match transactions across different data sets. It identifies commonalities like dates, amounts, and payees with remarkable accuracy.

Exception Handling Made Easy: Any discrepancies or unmatched transactions are flagged for your review. This allows you to focus your attention on potential issues and clear them up efficiently.

Workflow Revolution: Say goodbye to repetitive tasks! The system automates data entry, basic matching, and report generation, freeing up your team to focus on higher-value activities like financial analysis.

Enhanced Insights and Reporting: Gain valuable insights with comprehensive reports generated by the software. These reports summarize your reconciliation status, highlight trends, and identify potential inconsistencies.

Benefits of Using Automated Account Reconciliation:

Unmatched Efficiency: Free your team from the tedious task of manual reconciliation, allowing them to focus on higher-value activities and strategic planning.

Accuracy You Can Trust: Reduce human error and ensure data integrity with automated matching processes. This translates to a more reliable financial picture.

Time is Money: Streamline your financial processes and save valuable time previously spent on manual reconciliations. This translates to significant cost savings.

Improved Cash Flow Management: Gain real-time visibility into your cash flow with up-to-date reconciled accounts. This empowers better financial decisions.

Fraudulent Activity? No Problem: The system can identify potential discrepancies that might indicate fraudulent activity, safeguarding your financial wellbeing.

Enhanced Regulatory Compliance: Maintain accurate and reconciled records, simplifying compliance with accounting regulations.

Who Needs Automated Account Reconciliation?

This powerful tool is a game-changer for businesses of all sizes, particularly those facing challenges like:

High volume of transactions across multiple accounts.

Time-consuming and error-prone manual reconciliation processes.

Difficulty maintaining accurate and up-to-date financial records.

A need for improved financial reporting and analysis.

The desire to strengthen internal controls and fraud prevention.

Choosing the Right System for Your Needs:

With a diverse range of automation options available, here are some key factors to consider:

Features: Align the software's capabilities with your specific needs. This might range from basic matching to advanced features like anomaly detection, automated journal entries, and machine learning capabilities.

Integration: Ensure the system integrates seamlessly with your existing accounting software and other financial platforms.

Security: Choose a system with robust security measures to protect your sensitive financial data.

Scalability: Consider your future growth plans and choose a system that can adapt and scale with your business needs.

Ease of Use: Select a user-friendly system with an intuitive interface for a smooth adoption process by your team.

Embrace Automation, Empower Your Business:

By implementing automated account reconciliation, you're not just saving time and money; you're investing in the accuracy and efficiency of your financial operations. This translates to better cash flow visibility, improved decision-making, and ultimately, a stronger financial foundation for your business. So, ditch the manual approach and embrace the power of automation!

For more info. visit us:

Integrating Treasury Management Systems with ERP for Seamless Reconciliation