The global underground utility mapping market size is estimated to be worth USD 1,308.56 million in 2023 and is expected to reach USD 3,485.66 million by 2032, increasing at a CAGR of 11.5% between 2024 and 2032. This remarkable growth highlights the increasing importance of accurately locating underground utilities, which is essential for infrastructure development, safety, and efficient resource management. As urban areas expand and the demand for reliable utility mapping rises, understanding the trends and technologies driving this market becomes crucial.

Market Overview

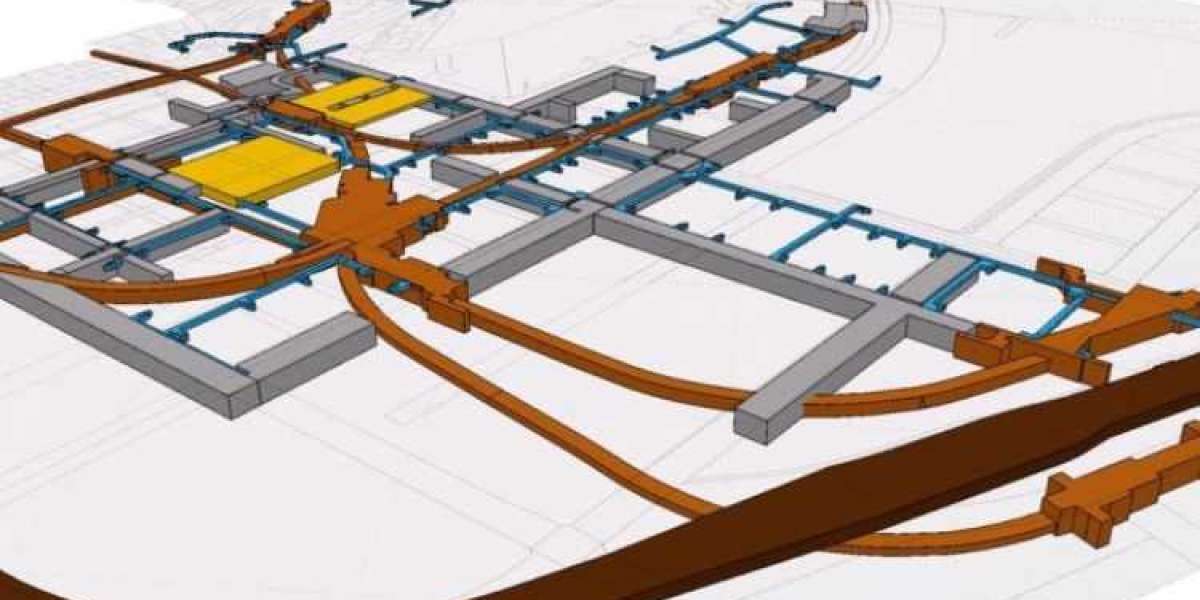

Underground utility mapping refers to the techniques and technologies employed to locate and visualize utilities buried beneath the surface, including water pipes, electrical cables, gas lines, and telecommunications infrastructure. Accurate mapping is vital for various industries, particularly in construction, urban planning, and environmental management. Inaccurate utility mapping can lead to costly damages, project delays, and safety hazards, making it imperative for stakeholders to invest in reliable mapping solutions.

The market's projected growth reflects the increasing adoption of advanced technologies and a heightened awareness of the risks associated with inadequate utility mapping. As cities continue to develop and upgrade infrastructure, the need for efficient and precise mapping solutions is becoming more pressing.

Technological Solutions

Electromagnetic Induction

Electromagnetic induction is one of the most widely used techniques in underground utility mapping. It works by generating electromagnetic fields that interact with conductive materials buried underground. This method is effective for locating metallic utilities, making it a popular choice in the industry.

Advantages:

- Non-invasive and efficient

- Provides real-time data

- Cost-effective for metallic utilities

Limitations:

- Limited effectiveness with non-metallic materials

- May require complementary technologies for comprehensive mapping

Ground Penetrating Radar (GPR)

Ground Penetrating Radar (GPR) uses radar pulses to image the subsurface. This technology is particularly beneficial for locating both metallic and non-metallic utilities, making it a versatile solution for mapping applications.

Advantages:

- Capable of detecting various materials, including plastics and concrete

- Provides high-resolution images of subsurface structures

- Useful in a wide range of applications, from construction to archaeology

Limitations:

- Interpretation of data requires specialized expertise

- Performance can be affected by soil conditions and other environmental factors

Other Technologies

Emerging technologies, such as acoustic and laser scanning, are also gaining traction in the underground utility mapping market. These technologies complement traditional methods and offer new ways to visualize subsurface utilities.

Innovations in machine learning and artificial intelligence are beginning to transform how data is analyzed, leading to improved accuracy and efficiency in utility mapping.

Market Segmentation by Components

The underground utility mapping market can be segmented into two primary components: technological solutions and services.

Technological Solutions

This segment includes all the tools and technologies utilized for utility mapping, including electromagnetic induction, GPR, and other emerging methods. The ongoing development of these technologies is driven by the need for greater accuracy and efficiency in locating underground utilities.

Services

The services component encompasses both professional services and managed services.

Professional Services: These include consulting, training, and on-site mapping services provided by experts in the field. Professional services enhance the reliability of mapping outcomes, as experienced technicians interpret complex data and ensure comprehensive assessments.

Managed Services: Managed services refer to outsourcing mapping tasks to specialized companies. This approach allows organizations to focus on core business functions while relying on external expertise for utility mapping, reducing overhead costs and enhancing operational efficiency.

End-Use Industries

Oil and Gas

The oil and gas sector is one of the largest consumers of underground utility mapping services. Accurate mapping is crucial for exploration, drilling, and pipeline management, as it helps mitigate risks associated with existing underground utilities. The increasing complexity of oil and gas operations demands advanced mapping technologies to ensure safety and efficiency.

Other Industries

Beyond oil and gas, various sectors utilize underground utility mapping. Telecommunications companies rely on accurate mapping to plan network expansions and avoid disruptions. Water and wastewater management agencies use mapping to maintain and upgrade infrastructure. Construction firms also benefit from utility mapping to avoid costly utility strikes and ensure compliance with regulations.

Regional Analysis

The underground utility mapping market varies significantly across regions, with North America, Europe, and Asia-Pacific being key players.

North America

The North American market is mature, driven by the rapid development of urban infrastructure and stringent regulations regarding utility mapping. The region's advanced technological landscape supports innovation, leading to increased adoption of GPR and electromagnetic induction techniques.

Europe

Europe is witnessing significant growth due to the emphasis on sustainable urban development and smart city initiatives. The region is focusing on integrating utility mapping with broader infrastructure planning, further driving demand.

Asia-Pacific

The Asia-Pacific region is experiencing the fastest growth, fueled by urbanization and infrastructure investments in countries like China and India. The rising awareness of the importance of utility mapping in mitigating risks associated with construction projects is propelling market expansion.

Competitive Landscape

The underground utility mapping market is characterized by a diverse array of players, from established companies to startups. Key players are focusing on innovation, developing new technologies, and forming strategic partnerships to enhance their market presence.

Companies are increasingly investing in RD to create integrated solutions that combine various mapping techniques, offering clients more comprehensive and accurate utility mapping services. Additionally, mergers and acquisitions are common as companies seek to expand their capabilities and reach new markets.